Despite the size of your business, outsourcing your pay-roll system can improve your one-upmanship, by freeing up useful time and sources that can be invested in boosting the quality of the service or product you offer. Sayings earn the knowledge with which they are associated by verifying real time as well as once again, and also there is no sage suggestions more accurate than this-- you have to spend cash to earn money. Purchasing a payroll service places much of your HR as well as monetary requirements in the hands of the professionals, permitting you devote your full attention to broadening your own knowledge in your selected area.

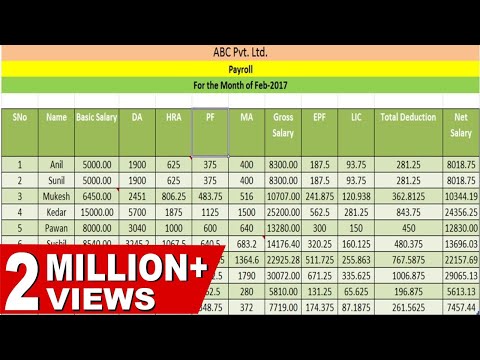

Payroll solutions take a substantial section of the day-to-day administration of your organisation and also location it in specialist hands. Outsourcing this crucial task ensures the timely and also accurate repayment of your retinue of personnel, which eventually leads to the development of the goodwill of what is perhaps any type of firm's crucial source. A satisfied work force makes for an effective company, and also with your payroll system in the hands of a company committed to the job, you can be sure that your work force will obtain the economic focus they are worthy of to assist them stay inspired.

Administering a payroll system can be a time consuming affair; the process includes not only the repayment of team however likewise managing questions and questions, problems with tax and any other issues that could emerge. Managing such issues, while an essential part in great staff management, can be taxing, detracting interest from the more imaginative areas of a firm's day-to-day tasks. Payroll solutions provide a company the flexibility to concentrate on what it is they do best, while ensuring that the team who make it happen are made up in a timely manner for the job they contribute to the table.

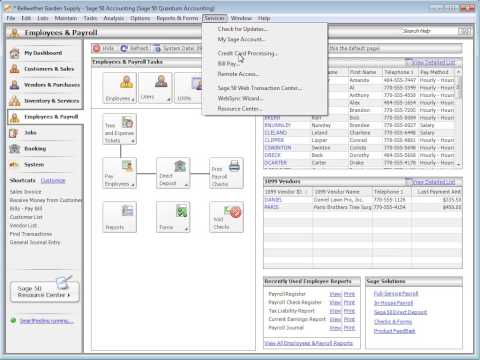

Numerous pay-roll firms offer a variety of various other services also, from various other HR services to reporting, helping you spend a lot more time on cultivating the product and services your company uses. There are also a series of speciality payroll solution companies, so be sure to select the one most very closely affiliated with your firm's industry. Particular types of payroll services login service will have certain pay-roll needs; the friendliness industry, for example, requires the proper management of suggestions. For the greatest benefit to your business, make certain to choose a pay-roll service advisor that can adapt themselves to the demands of your business.

Enhance your company by outsourcing your payroll management to a specialist company, as well as devote your beneficial time to what it is your company does best.